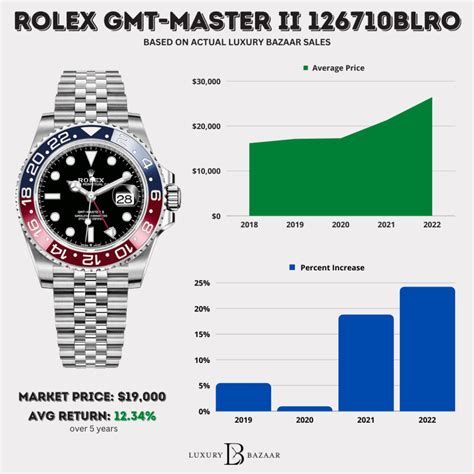

how much is tax on a rolex | rolex value chart how much is tax on a rolex If you want a date complication, the current reference 126610LN is down by four percent. This sets these desirable models right around retail prices (plus tax). NVIDIA GeForce 6 series or ATI 1300XT series video card, or equivalent. installing the crucial mods to improve performance. stop crashes. make sure to keep saving your game anyway. this is the .

0 · rolex watch average price

1 · rolex value chart

2 · rolex switzerland price list 2022

3 · rolex pricing chart

4 · rolex price malaysia 2023 guide

5 · rolex price increase 2022 list

6 · rolex price chart 2023

7 · rolex canada price list 2023

It features a gleaming hardware key ring engraved with the Louis Vuitton signature along with an LV Link charm suspended below. This functional piece is a decorative accessory that can also be clipped onto the handle of a bag.

rolex watch average price

laarzen gucci

When purchasing a Rolex, Audemars Piguet, Patek Philippe, or any other luxury timepiece for that matter, any state or local sales taxes that are added can make a big . The most recent tax value of Rolex in the US market is 18% to 20% selling price. According to the Harmonized tariff schedule of the US, the applicable subheading for the Rolex submariner watches will be 9102.21.70 and the other one . When purchasing a Rolex, Audemars Piguet, Patek Philippe, or any other luxury timepiece for that matter, any state or local sales taxes that are added can make a big difference to the total amount you pay. In total, 45 US states, plus the District of Columbia, currently collect state-wide sales taxes, while 38 states collect local sales taxes. I have done a few searches here that brought back some dated threads and Google searches. Google shows a roughly 3% federal import tax, and I am also unsure whether New York state will tax me as well (given how much they love finding a tax on practically anything, I would not be surprised).

If you want a date complication, the current reference 126610LN is down by four percent. This sets these desirable models right around retail prices (plus tax).

Learn how much is a Rolex and what is a Rolex worth using our 2024 prices guide. Find the most updated information based on pricing availability in the watch market. The U.S. has a tax exemption of 0 per person on items bought abroad. Family members can combine their 0 tax exemptions in a joint declaration of value. Items valued ,000 over the exemption are taxed at 3 percent. Beyond that, the tax rate climbs to 6.5 percent. The retail price here for a Sub w/date is ,750 CAD plus a 5 - 13% SALES TAX. If you are a tourist you can get the 5-13% back (depends upon the province you are in at the time of sale) after you leave the country by way of a refund process. Unless it’s a Rolex. Then be happy with a 20 percent discount or less. Probably less. Understand that the shop may factor the local tax you’re saving from duty free as part of your computed discount.

Most people looking to sell Rolex watches just want to know what is it worth and what is a fair price I can get for it. If you are in the market to sell your Rolex watch, browse our pricing sheet to determine the current market value of any given model.

According to the U.S. Customs and Border Protection, there is a Merchandise Processing Fee of 0.21%, generally on watches over 00. The exemptions depend on where and what, but watches may be duty free if they range anywhere from 0-00. This doesn’t always work as I’ve had to pay customs to import a vintage Omega that cost 57. The most recent tax value of Rolex in the US market is 18% to 20% selling price. According to the Harmonized tariff schedule of the US, the applicable subheading for the Rolex submariner watches will be 9102.21.70 and the other one . When purchasing a Rolex, Audemars Piguet, Patek Philippe, or any other luxury timepiece for that matter, any state or local sales taxes that are added can make a big difference to the total amount you pay. In total, 45 US states, plus the District of Columbia, currently collect state-wide sales taxes, while 38 states collect local sales taxes.

rolex value chart

I have done a few searches here that brought back some dated threads and Google searches. Google shows a roughly 3% federal import tax, and I am also unsure whether New York state will tax me as well (given how much they love finding a tax on practically anything, I would not be surprised). If you want a date complication, the current reference 126610LN is down by four percent. This sets these desirable models right around retail prices (plus tax).Learn how much is a Rolex and what is a Rolex worth using our 2024 prices guide. Find the most updated information based on pricing availability in the watch market. The U.S. has a tax exemption of 0 per person on items bought abroad. Family members can combine their 0 tax exemptions in a joint declaration of value. Items valued ,000 over the exemption are taxed at 3 percent. Beyond that, the tax rate climbs to 6.5 percent.

The retail price here for a Sub w/date is ,750 CAD plus a 5 - 13% SALES TAX. If you are a tourist you can get the 5-13% back (depends upon the province you are in at the time of sale) after you leave the country by way of a refund process.

Unless it’s a Rolex. Then be happy with a 20 percent discount or less. Probably less. Understand that the shop may factor the local tax you’re saving from duty free as part of your computed discount.Most people looking to sell Rolex watches just want to know what is it worth and what is a fair price I can get for it. If you are in the market to sell your Rolex watch, browse our pricing sheet to determine the current market value of any given model.

M62709. LV Dragonne key holder. $310.00. Find a Store Near You. Product details. Delivery & Returns. Gifting. Featuring our emblematic LV initials frame, this functional key-holder is a man's must-have. It comes in three of our iconic materials matching the Maison's Leather Goods range.

how much is tax on a rolex|rolex value chart